Have you ever wondered “WHEN WILL THIS ALL SETTLE DOWN?” about the Puget Sound real estate marketplace?

- Home prices – How high can they go?

- Interest rates – When will they start going up again?

- Household Income – Will my monthly paycheck keep pace with rising housing costs?

Oh, if ever there was a need for a modern-day Nostradamus it is now! And WHERE is that Jamaican lady spokesperson for the PSYCHIC HOTLINE that we used to see on late night TV, telling us to “CALL ME NOW!” for answers to all of life’s questions?

Well she’s now bartending at the Miami Ritz-Carlton so she can’t help either!

But fear not, for I recently visited The Crystal Voyage here in T-Town and purchased a pocket crystal ball to give me guidance in the answers I am about to give you.

Here are the answers:

1 – Higher

2 – Soon

3 – No

Now let’s move on to some very specific local statistics and how they might affect us.

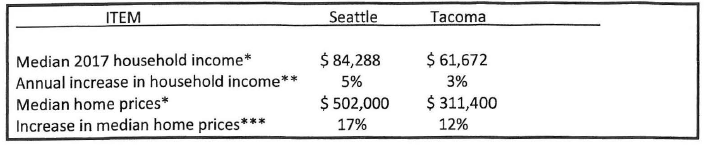

SOURCES:

* -FORBES 11Best Places for Business and Careers in 2017”

** -US Census Bureau – 2017

***- Zillow -1 year changes in median home prices in Seattle and Tacoma (2016-2017)

Now, using these statistics and attempting to gain a view of the future …

CONSIDER THE FOLLOWING SCENARIO:

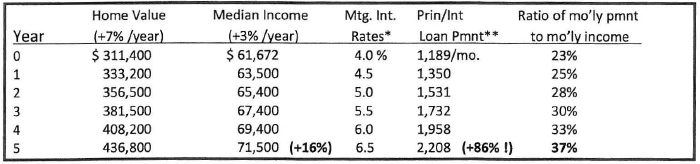

You are considering buying a Tacoma home currently worth $314,400.

Yours is a typical Tacoma household with current income of $61,672.

Let’s assume home values continue to rise, but at only 7% / year instead of 10-12%.

Let’s also assume that mortgage interest rates increase at a gradual 1/2% / year.

QUESTION- What happens if you consider buying each year for the next 5 YEARS … but don’t?

* – Assuming an annual mtg interest rate increase of .5% / year for the next 5 years

** – Monthly loan payment (Prin & lnt) based on a 80% loan and a 30 year term

QUESTION – So Mr. Buyer … notice anything?

ANSWER – “Why YES! After 5 years my potential mortgage payment shot up 86% while my income only went up 16% ! And oh yeah … with a payment/income ratio of 37%, I NO LONGER QUALIFY FOR A LOAN to buy my dream home.”

(Take a second look- your ability to QUALIFY FOR A LOAN to buy the house you have always wanted actually vanished around YEAR# 3 because a long held “general rule of thumb for home loans” is that your home payment shouldn’t exceed about 30% of your income.)

So what’s the point of all this?

There are 2 points, actually, and, if you are ready to listen, here they are:

- To potential buyers -If you don’t own where you live, BUY A HOME NOW!

If you already own the home you live in, BUY A RENTAL NOW! - To rental owners- Thank your lucky stars! You own an asset that typically returns 4-7% annually AND has been appreciating 8-12% annually. As any dairy farmer would tell you,

“Hang on to that cow … and maybe buy another one too!”